Keith Harwood, OptionHotline.com

Over the last two weeks, we’ve seen an increase in a major index that’s breaking out now and looks like it wants to get very bullish. And this is bad news.

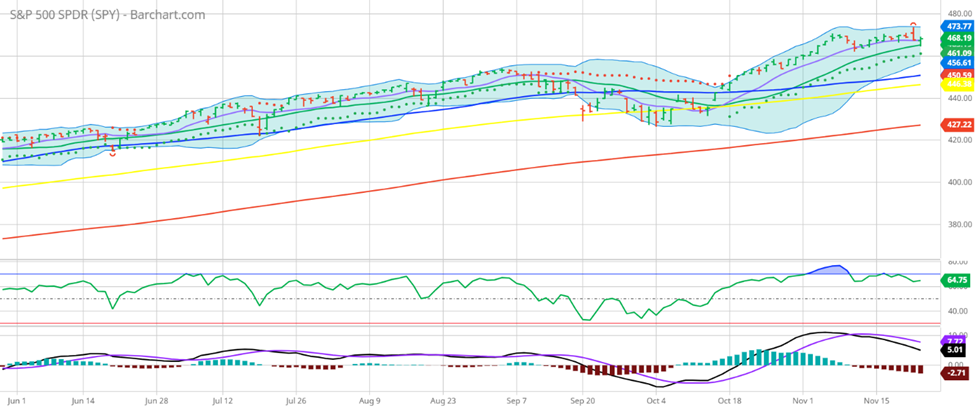

No, I’m not speaking of the S&P 500 (via ETF SPY). As you can see, that’s not breaking out after peaking on Monday and then pulling back to the 20-Day Moving Average on Tuesday:

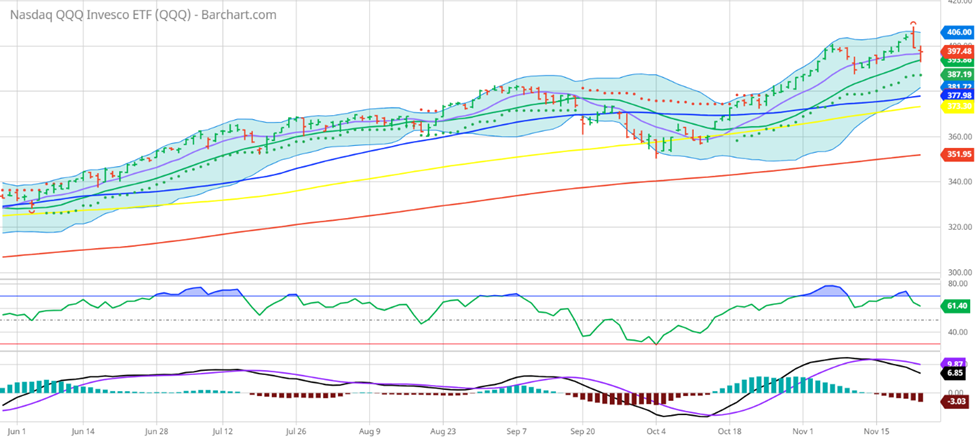

No, I’m not referencing our market leader, the NASDAQ 100 (via ETF QQQ). As you can see, that’s also not breaking out after peaking on Monday and pulling back to the 20-Day Moving Average on Tuesday (sound familiar?):

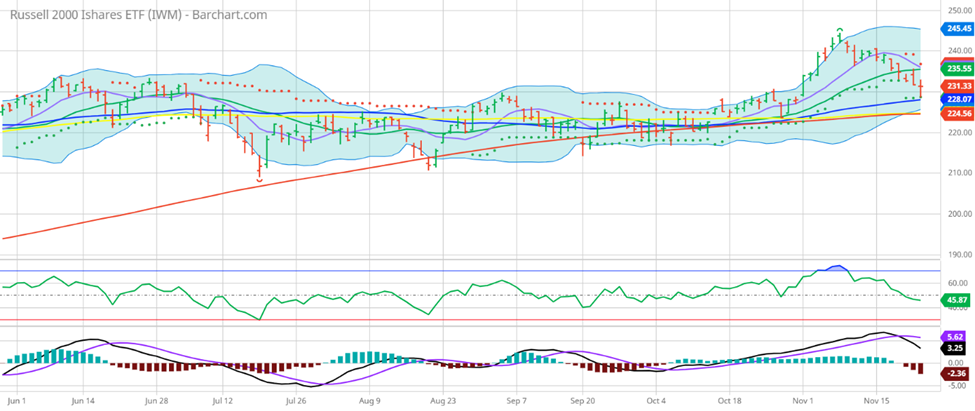

And I’m certainly not speaking about the Small Caps (via ETF IWM). As you can see, that ETF peaked more than a week ago, and pulled back even more to the 50-Day Moving Average on the back of recent weakness in oil, financials, and others:

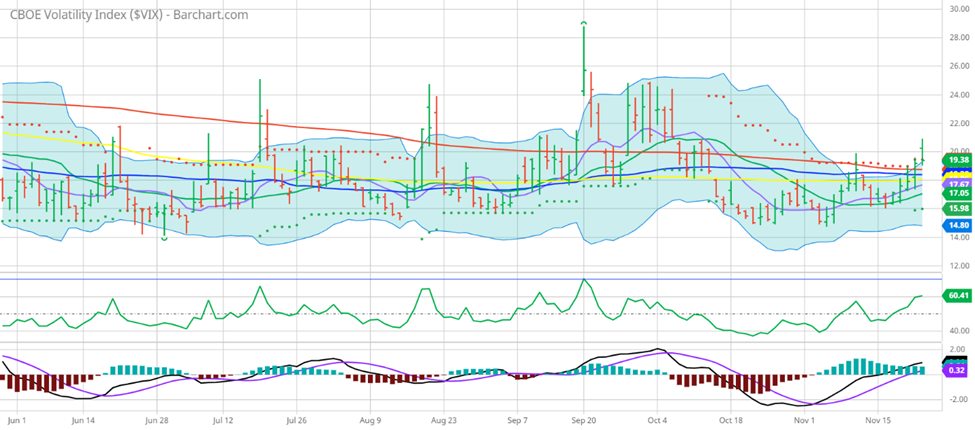

What I’m seeing is a spike in the most important index for an option trader – the Volatility Index (VIX):

The VIX has been effectively trendless for over a month, but now is at recent highs when the market is not yet near the recent lows. So, why is the VIX going up so much if the market pullback is minimal and both SPY and QQQ are still trading near highs? Perhaps someone had sold a large number of calls in the market trying to call a top and is now having to cover their position. Perhaps someone simply sees major volatility off of general market uncertainty into the end of year. Normally, the market isn’t too volatile around major holidays – people don’t tend to make major moves when others are trying to take vacation and it’s unlikely that we get news (December 2018 comes to mind as an anomaly, of course).

But now, we are getting a setup in the VIX that tells me that the pullback is probably not done. IWM may be leading a more major market risk reduction. No, it’s not bearish long-term to see a VIX in the 20% range. But, if it keeps going up and panic sets in, it could set us up for a good pullback in all sectors.

I’ve said for a few weeks that I’m worried about a market top. This move in the VIX changes nothing about that opinion for me today.

So, please go to https://optionhotline.com to review how I traditionally apply technical signals and probability analysis to my options trades. As always, if you have any questions, never hesitate to reach out.

Keith Harwood

Keith@optionhotline.com

Recent Comments