Early last week we noticed signals that the market was about to drop. You can see what we were looking at in the article here. When you spot moves like that the key is to know how to exploit them. Lets take a look at the chart of the S&P:

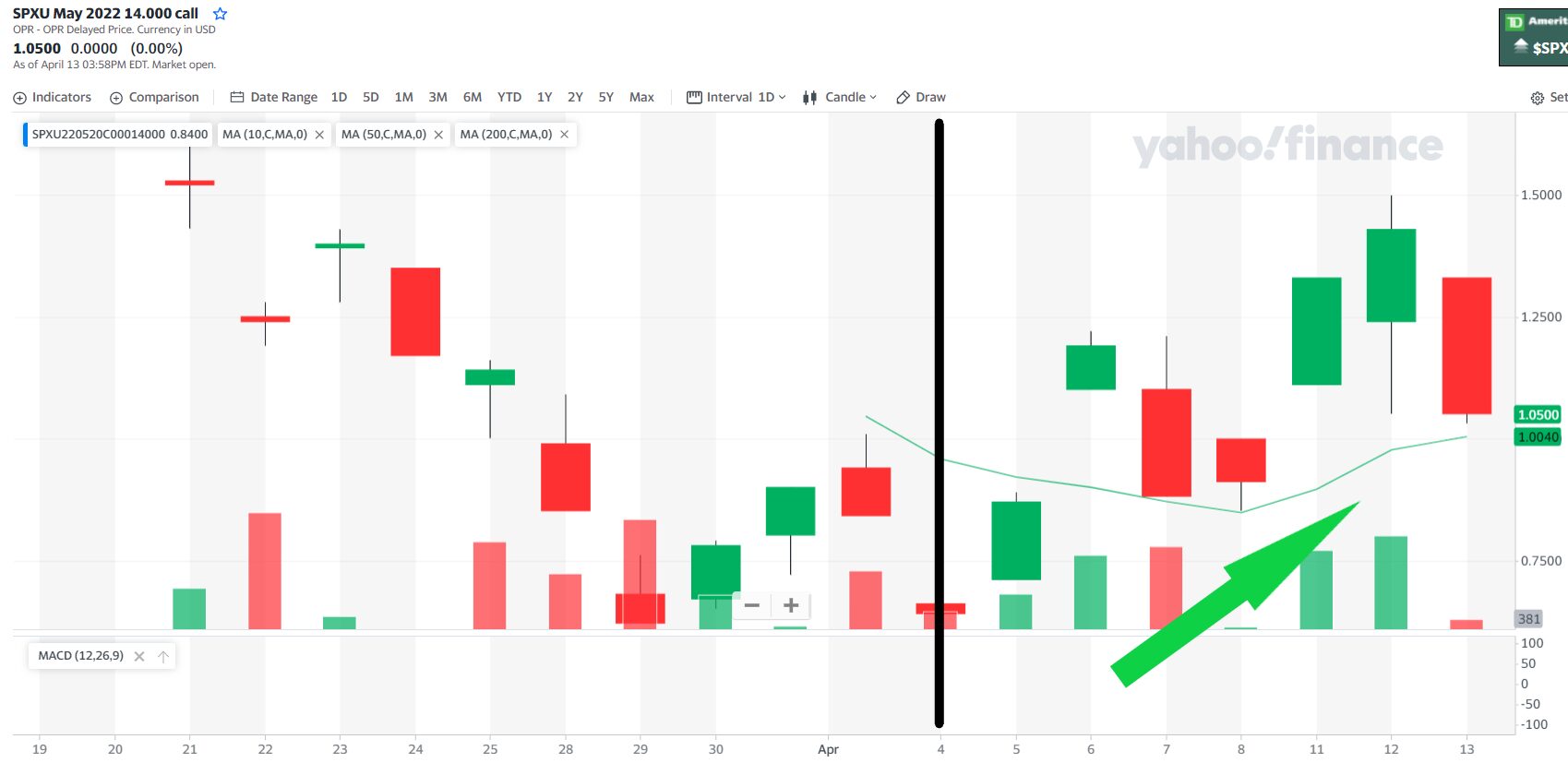

The black vertical line shows where we saw the signs of the drop. Now take a look at SPXU. This is an inverse ETF that tracks the S&P. (We have also talked about using index ETFs and inverse index ETFs here). Inverse ETFs go in the opposite direction of the index so SPXU goes up when the S&P goes down.

You can see the line on this chart show our signals were dead on and offered a good entry point. Making a buck a share isn’t all that exciting. But if you look at how using a call option in this case would have worked, you start to see the power of using momentum combined with the leverage of options can really do for your account.

A May 20 14 call option wasn’t a crazy trade. With all signs pointing to the S&P dropping and SPXU going up, it was pretty likely to play out and hit and go above 14. We the signals flashed, that call option was about $.65. Over the next week there was ample time to exit with a quick 100% gain.

When you can confirm the momentum with the right tools, the likelihood of your trades generating more profit dramatically increases. Lee Gettess has put together some of the most effective momentum tools and is a great source for understanding how to make this work for you. Be sure to check it out here.

Keep learning and trade wisely,

John Boyer

Editor

Market Wealth Daily

Recent Comments