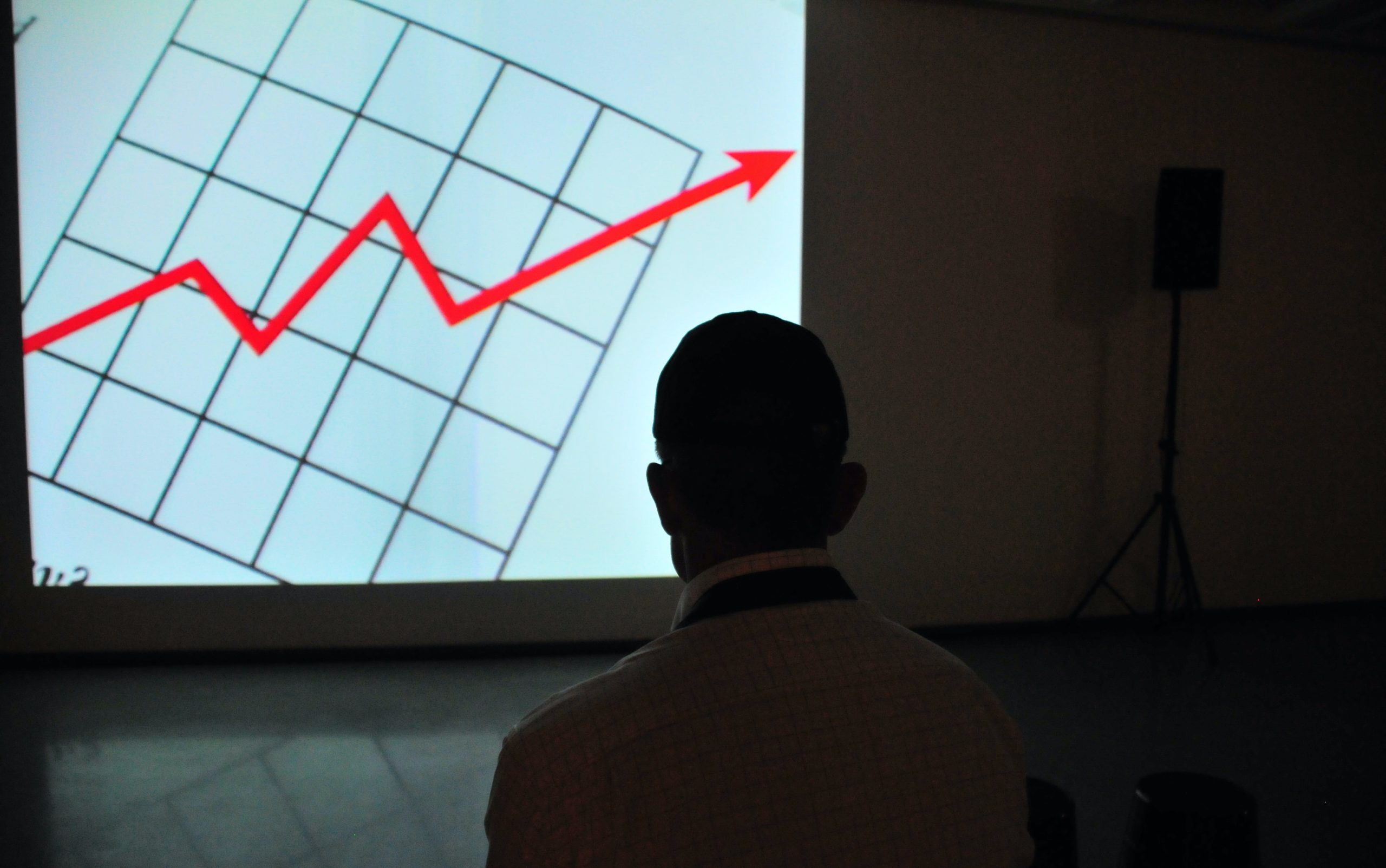

The S&P had a strong week last week. In fact, the classic market bellwether moved above a key point to close out the week and set up a sign of a shift to a rally and a potential S&P reversal. It could be short term but we can take a look at the MACD to get a sign of how much power this latest move has.

Let pull up the chart and look for three important signs.

The first thing we want to see is the MACD cross over to the upside. This is where the red line in the indicator at the bottom of the chart above crosses the red line. This is telling us that the stock i moving up and has some strength to indicate there will be more buying and it is likely to keep going up. But a cross over is not the only thing we want to see.

The circle back in February shows that we had a cross over but it didn’t add up to much. The next thing we look at is where the stock is in relation to key moving averages. In the red circle we can see that the stock moved above the 10 day moving average but didn’t break through the 50 day moving average. This tells us it was a weak move without much energy.

The other clue we can look for is what we saw in the S&P last week. If you look at the angle of the cross over in the blue circle you can see that the angle once the MACD crosses over stays steep. This is another factor telling us the momentum is there and this could start a rally.

Considering the broader market context we wouldn’t want to bet on anything long term for this rally but if we can move the S&P above the 200 day moving average and keep it there, finding other winners across the market should get easier.

Keep learning and trade wisely,

John Boyer

Editor

Market Wealth Daily

Recent Comments