Dear Reader,

Yesterday, we looked at a Daily Price Chart for Advanced Micro Devices, Inc. noting that the stock 24/52 Day MACD is trading above the 18-Day EMA.

For today’s Trade of the Day e-letter we will be looking at a daily price chart for Palo Alto Networks Inc. stock symbol: PANW.

Before breaking down PANW’s daily chart let’s first review what products and services the company offers.

Palo Alto Networks, Inc. provides cybersecurity solutions worldwide. The company offers firewall appliances and software; Panorama, a security management solution for the control of firewall appliances and software deployed on a customer’s network, as well as their instances in public or private cloud environments, as a virtual or a physical appliance; and virtual system upgrades, which are available as extensions to the virtual system capacity that ships with physical appliances.

Now, let’s begin to break down the Daily Price chart for PANW stock.

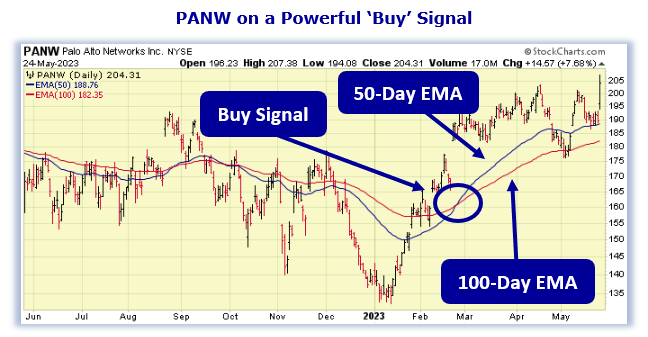

Below is a Daily Price chart with the 50-Day EMA and 100-Day EMA for PANW.

50-Day EMA and 100-Day EMA ‘Buy’ Signal

The 50-Day Exponential Moving Average (EMA) and 100-Day EMA are moving average indicator lines that can provide buy and sell signals when used together. When the shorter-term 50-Day EMA crosses above or below the longer-term 100-Day EMA, this provides either a buy or sell signal depending on which direction the stock price is moving.

- 50-Day EMA line Above 100-Day EMA = Price Uptrend = Buy signal

- 50 Day EMA line Below 100-Day EMA = Price Downtrend = Sell signal

When the 50-Day EMA (blue line) crosses above the 100-Day EMA (red line) this indicates that the stock’s buying pressure has begun to outweigh the selling pressure signaling a ‘buy’ signal. When the 50-Day EMA crosses below the 100-Day EMA this indicates that the selling pressure has begun to outweigh the buying pressure signaling a ‘sell’ signal.

Buy PANW Stock

As the chart shows, on February 23rd, the PANW 50-Day EMA, crossed above the 100-Day EMA.

This crossover indicated the buying pressure for PANW stock exceeded the selling pressure. For this kind of crossover to occur, a stock has to be in a strong bullish trend.

Now, as you can see, the 50-Day EMA is still above the 100-Day EMA meaning the ‘buy’ signal is still in play.

As long as the 50-Day EMA remains above the 100-Day EMA, the stock is more likely to keep trading at new highs and should be purchased.

Our initial price target for PANW stock is 212.50 per share.

Profit if PANW is Up, Down or Flat

Now, since PANW’s 50-Day EMA is trading above the 100-Day EMA and will likely rally from here, let’s use the Hughes Optioneering calculator to look at the potential returns for a PANW call option spread.

The Call Option Spread Calculator will calculate the profit/loss potential for a call option spread based on the price change of the underlying stock/ETF at option expiration in this example from a 7.5% increase to a 7.5% decrease in PANW stock at option expiration.

The goal of this example is to demonstrate the ‘built in’ profit potential for option spreads and the ability of spreads to profit if the underlying stock is up, down or flat at option expiration. Out of fairness to our paid option service subscribers we don’t list the option strike prices used in the profit/loss calculation.

The prices and returns represented below were calculated based on the current stock and option pricing for PANW on 5/24/2023 before commissions.

Built in Profit Potential

For this option spread, the calculator analysis below reveals the cost of the spread is $317 (circled). The maximum risk for an option spread is the cost of the spread.

The analysis reveals that if PANW stock is flat or up at all at expiration the spread will realize a 57.7% return (circled).

And if PANW stock decreases 7.5% at option expiration, the option spread would make a 25.8% return (circled).

Due to option pricing characteristics, this option spread has a ‘built in’ 57.7% profit potential when the trade was identified*.

Option spread trades can result in a higher percentage of winning trades compared to a directional option trade if you can profit when the underlying stock/ETF is up, down or flat.

A higher percentage of winning trades can give you the discipline needed to become a successful trader.

The Hughes Optioneering Team is here to help you identify profit opportunities just like this one.

Interested in accessing the Optioneering Calculators? Join one of Chuck’s Trading Services for unlimited access! The Optioneering Team has option calculators for six different option strategies that allow you to calculate the profit potential for an option trade before you take the trade.

Trade High Priced Stocks for $350 With Less Risk

One of the big advantages to trading option spreads is that spreads allow you to trade high price stocks like Amazon, Google, or Netflix for as little as $350. With an option spread you can control 100 shares of Netflix for $350. If you were to purchase 100 shares of Netflix at current prices it would cost about $36,000. With the stock purchase you are risking $36,000 but with a Netflix option spread that costs $350 your maximum risk is $350 so your dollar risk is lower with option spreads compared to stock purchases.

Chuck’s $3,000 Trading Scholarship

I don’t want you to miss a single opportunity to potentially reach your goals. That’s why I’d like to offer you a scholarship of the full $3,000 Enrollment Fee of my exclusive Weekly Option Alert Trading Service**.

I want you to follow in my footsteps for the opportunity to succeed beyond your wildest dreams, so please call Brad in my office at 1-866-661-5664 or 1-310-647-5664 and get started today!

You can also CLICK HERE to schedule a call now!

Wishing You the Best in Investing Success,

Chuck Hughes

Editor, Trade of the Day

Have any questions? Email us at dailytrade@chuckstod.com

*Trading incurs risk and some people lose money trading.

**Weekly Option Alert Trading Service program provides training package and specific trade signals for one year. The first 10 people to sign up each day this offer is valid, will get a waiver of the standard fee, which is the price charged to anyone signing up after the first 10 people per day.

Recent Comments