What is a put debit spread:

A put debit spread (also called a bear put spread) is a bearish strategy with limited risk and limited reward. It can allow you to purchase a long put for much cheaper than it would otherwise be.

How to create a put debit spread

A put debit spread is created by purchasing a put option on a stock and then selling a second put option at a lower strike price. This is a vertical spread, so you will choose the same expiration date for both options contracts.

When would you use this strategy?

You might choose to create a put debit spread when you’re bearish on the stock, but you want to limit your exposure to risk while also reducing your cost basis on the trade.

To understand how this works, let’s consider each component of a put debit spread individually.

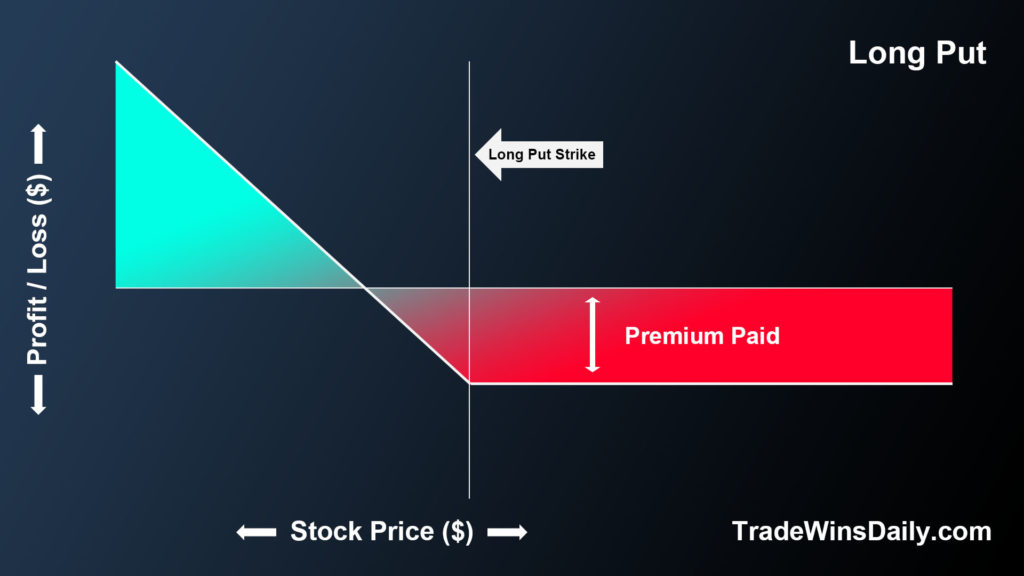

Let’s start with the long put option. (in other words, you’re buying the put)

You can learn more about call and put options here

Notice in the chart above that the long put option has limited risk, and indefinite profit potential if the price of the stock decreases.

Notice, this trade won’t be profitable unless the stock decreases to the point where it covers the premium you’ve paid to purchase the put option.

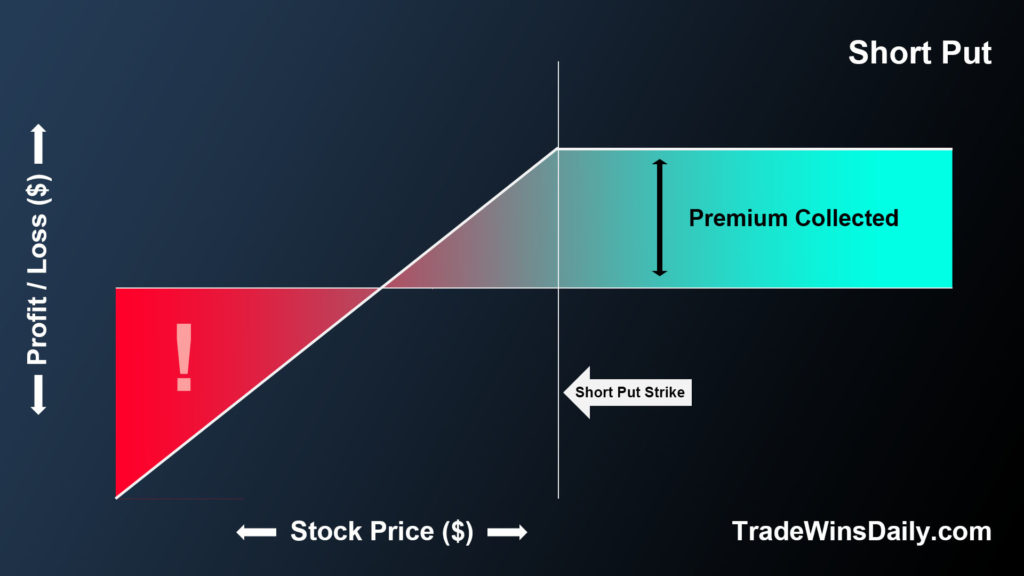

Now, let’s examine the other component of a bear put spread: the short put option (or in other words, selling a put).

Notice in the chart above that the short put option is the inverse of the long put. By itself, a short put is a bullish strategy that becomes profitable when the price of the stock remains above the strike price until expiration.

Because you’re selling this option, you’ll receive a credit into your account when you place the trade. This means that the price of the stock could decrease by some amount, and the trade will remain profitable as long as the decrease in price is less than the premium you collected at the beginning.

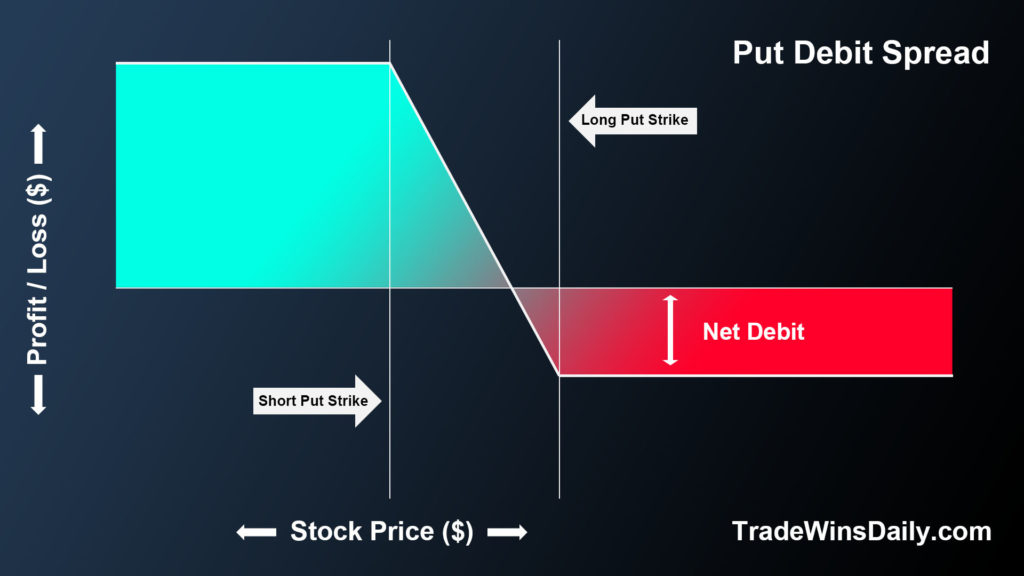

Now let’s consider how to use these two options contracts together to create a put debit spread.

First, you’ll purchase a put option for a certain amount of premium. Then you’ll sell a put option on the same expiration date, at a lower strike price.

Because options become cheaper the further they get from the current stock price, the premium you collect from your short put will be less than the premium you paid for your long put. This results in what’s called a “net debit” from your account.

What does this mean? Take another look at this long put chart. Notice that it will cost a certain amount of premium to enter into this trade. By selling the other put option at a lower strike price, you’ll be able to collect some premium which will reduce your cost basis on the trade.

This strategy will put a limit on your profit potential, but it is very useful for entering into a bearish position on the stock that might otherwise be too expensive for you to enter alone with only a long put.

Also, consider that the maximum potential loss on a long put is equal to the premium you pay to purchase the put contract. By creating a put debit spread, you’ll effectively reduce your overall risk on the trade by reducing your cost to enter.

Your maximum loss on the trade is equal to the premium you pay for the long put, minus the credit you receive for selling the short put.

Maximum loss = Long put debit – Short put credit

Your maximum profit on the trade occurs when the stock price decreases below your short put strike price.

How to exit a put debit spread

If your bearish prediction on the stock proves accurate, and the price decreases, you should aim to exit this trade for a profit. You can do this by buying-to-close your short put, and selling-to-close your long put option.

Your profit on the trade will be equal to the value of the long put option minus the value of the short put option, and minus the debit you paid to enter into the spread.

Profit = Value of long put – (value of short put + original debit paid)

When should you close out this trade?

You can close out the trade at any time before the expiration date. If the trade has reached its maximum profit, it is probably wise to exit the trade immediately.

If you choose to keep the trade open until expiration, there are a few possible scenarios that could play out.

- if the stock price is lower than your short strike at expiration, both contracts will close and you’ll receive the full potential profit.

- if the stock price is higher than the long put strike price, both contracts will close and you’ll realize the full potential loss on the trade.

- If the stock price is between the short put strike and the long put strike, you may realize a slight gain, loss, or break even.

Even though you could potentially let the position expire and receive full profit, it’s probably best to close the position as soon as you reach your profit target.

Recent Comments