| From Keith Harwood of OptionHotline…The markets have been going through a series of rotations that allow for opportunistic buying in almost every sector. And now, with a new trend forming, it may be time for more of a “buy and hold” strategy in a sector that has been lagging the overall market moves for much of the year. Throughout the year, the story has been tech’s underperformance. Small caps were simply getting more money flow with strong oil prices and a potential economic “return to normal” thanks to the COVID-19 vaccine. But, at some point, we know that tech always has a home in the portfolio, and there is a big signal that triggered this week that perhaps tech can start being the market leader going forward. Let’s look at the chart for QQQ: (more below) |

A few notes here that are important.

First, tech IS overbought – with a 72.60 RSI, it is a bit tough to chase the move. But that doesn’t mean that I can’t buy tech. It simply means that we may see a minor dip or consolidation in the next few days. So, I do not particularly want to play for an explosive upside move this week, especially as this move has been grinding higher for weeks already.

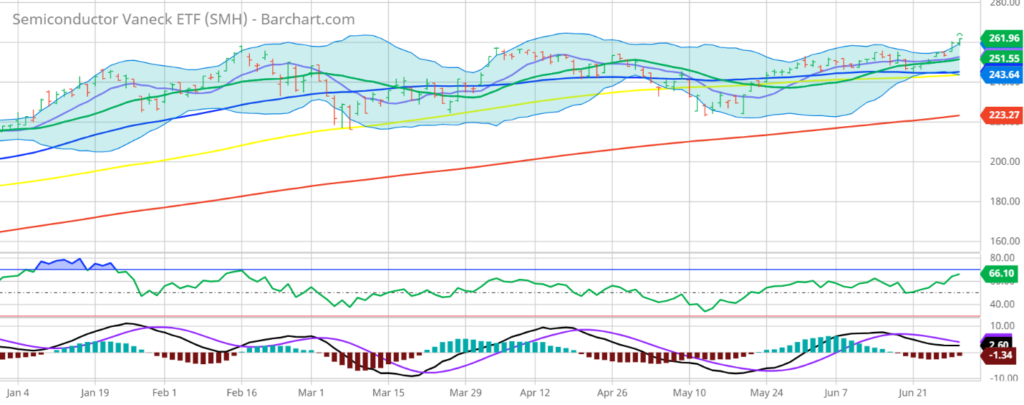

Second, we got a major move in SMH (semiconductors) that helps signal a lot of power for tech, as it has traditionally been a leader within the tech sector:

And on that note, SMH is NOT overbought, but it is breaking out of a range and making new highs. SMH is my big signal for tech, and it is happening right now. This is a great sign for continued momentum in tech.

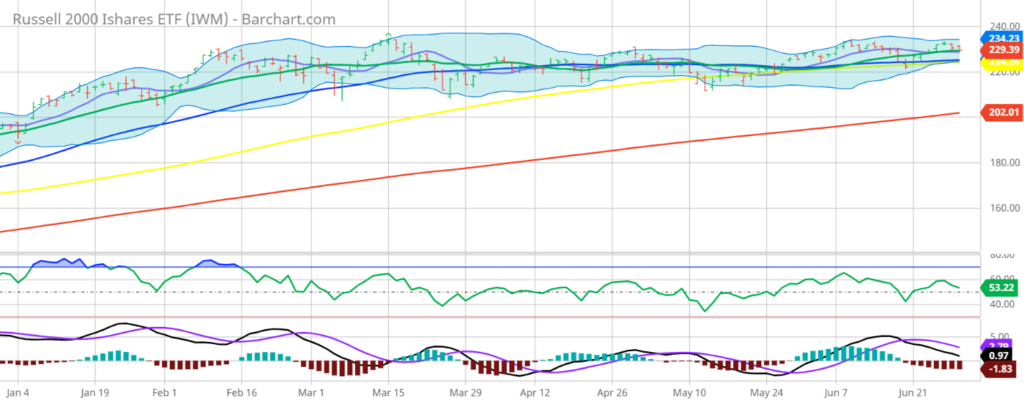

But I have to find a place where the market is selling, otherwise I get nervous that everyone is buying everything and there’s a lack of money that can enter the market (even with all the stimulus out there). And that, right now, is small caps:

Since small caps are NOT breaking out, I can see that this is still a selective market overall and people are looking for what is undervalued relative to other sectors. Tech seems like the winner, for now. So, my focus is on tech for now. Once small caps break out to a new high, I will have to repeat the evaluation to see if that is a place I want to rotate into, or if it is a better time to reduce overall risk. For now, rotating into tech seems to be the highest probability answer to the question of what I want to do next.

Please take this chance to review how I apply technical signals to my options trades at https://optionhotline.com and if you have any questions, never hesitate to e-mail me.

Keith Harwood

Keith@optionhotline.com

Recent Comments