The market is breaking out of the recent range and showing a general bullish bias after weeks of chop, and that is setting up a lot of potential opportunities.

As the economy is showing relative stability with a positive Non-Farms Payroll, the elephant in the room remains finding a concrete resolution to the US-China trade negotiations, which appear to be taking a major step forward at this time. How stocks and sectors are impacted, both in the positive and negative aspect, remains to be seen, but what is clear is that making that unknown a known is helpful for the trader and investor that is looking for more information before choosing where their capital allocations can and should be focused.

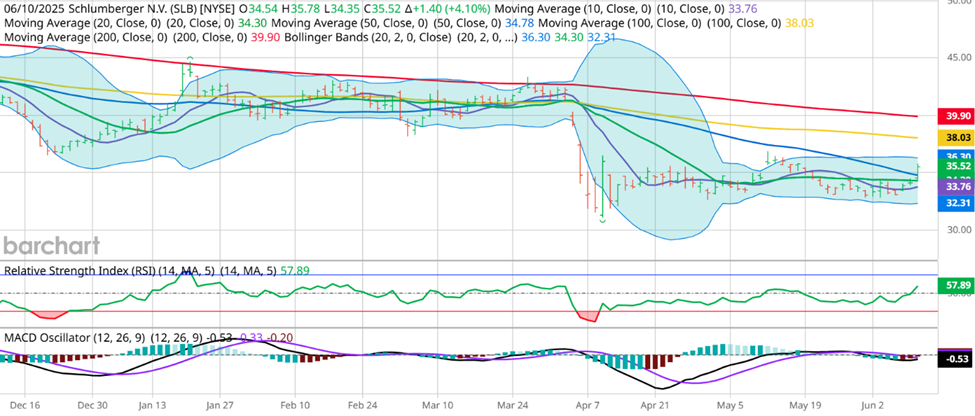

Before I get into a new idea, I want to review the last two weeks of discussion. First off, we had the potential for bullish behavior in SLB:

While the first week of price action was choppy if not a bit bearish, SLB finally caught on with the bullish price action in crude oil and spiked yesterday. After testing the upper range of the recent price action, SLB is no longer in focus for me and in my view, it’s time to take the profits that took a bit longer to materialize than initially hoped. With this move, the June 20th $34 calls increased from $1.07 to $1.80 (a 68% return) while the June 20th $34.5/$36.5 call spread increased in value from $0.54 to $1.04 (a 93% return). But ultimately, it’s time to find something new to generate higher expected returns going forward. It may continue higher, but it’s not a high conviction bullish setup for me anymore.

Similarly, we discussed the bullish potential in NUE last week:

The Stock Forecast Toolbox initially predicted a pullback followed by a re-test of recent highs if not further bullish behavior, and with the price action going fairly in hand with that expectation, one may consider the possibility of moving on from this trade, but perhaps it’s a bit early to conclude this trade. The July 18th $125 calls have increased in value from about $4.50 to $5.70 on this move, and compounding 25%+ winners would certainly generate a spectacular long-term return. But I should note here that the Stock Forecast Toolbox predicts further upside, so holding onto this position for a bit longer is certainly justified in many ways:

While this opportunity will be re-visited next week, I don’t want to beat the same drum without adding something new to the mix.

So, for a brand-new opportunity that I’m seeing as particularly attractive today is in a completely different sector – namely, financials. And that stock is FITB:

Fifth Third Bank is showing a nice start to a bullish move with a close above the 100-Day Moving Average. Tuesday’s close was right on the highs from May 16th at $39.78. As buying is often predicted with a close above the 100-Day Moving Average and a breach of recent highs that act as resistance, I also turned to the Stock Forecast Toolbox to see what AI is predicting happens next, and it’s nothing short of exceptional:

Looking at the projected price action, the Artificial Intelligence prediction is for a closing price around $41.50 on June 18th, which would equate to a 5.4% rally in the stock. Utilizing a simple outright long call structure like the July 18th $40 calls which closed on Tuesday at $1.18 would be a very interesting leveraged play for me, with a potential for these options to double or more if the predicted price action comes to fruition. Of course, nothing is guaranteed, so having the defined risk of options is another crucial element to my trade construction here. We never know when a market input is going to shake things up and cause a major rally or sell-off, so if I can get leverage in the bull case and defined risk via the premium paid for these calls in case of a reversal, that looks like a winning recipe for me.

If you’d like to get your hands on the Stock Forecast Toolbox, you can access a free trial HERE.

And as always, please go to http://optionhotline.com to review how I traditionally apply artificial intelligence, technical signals, volatility analysis, and probability analysis to my options trades. And if you have any questions, never hesitate to reach out.

Keith Harwood

Keith@OptionHotline.com

Recent Comments