by David L. Caplan

The “free trade” combines the best principles of money management and taking advantage of “undervalued” and “overvalued” options. However, the most exciting aspect of the “free trade” is that it can allow you to build a large position in a trending market without risking your initial risk.

To initiate the “free trade,” first purchase the best-priced option. Then, when (and if) the price and volatility (premium) rise, sell a further out-of-the-money option at the same price. (Of course, if the market does not move in your favor, you cannot complete the “free trade.”) Another benefit of the “free trade” is that after it is completed there is no margin, capital necessary, or potential loss (other than brokerage fees and costs).

The “free trade” accomplishes several objectives:

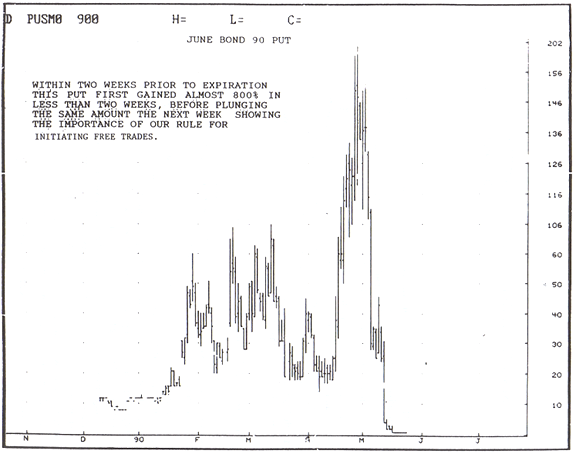

First, it keeps your account intact if the market turns around. Just as quickly as markets rise, they can also fall. The “free trade” position provides protection from loss in this situation (see chart).

Second, if the market moves in your favor, you can continue to add to your position on the next pull-back. If the trend remains intact and the market pulls back, as it eventually does, you are then in a position to purchase another option to begin building a larger position. You can then look to turn the second position into a “free trade” using the same method without increasing your initial risk. By doing this you can take advantage of the normal swings of the market to purchase options when they are cheapest, and sell them when they are the most expensive, on rallies. Further, you will be purchasing “closer-to-the-money options” which are normally the most fairly valued options and selling “out-of-the-money options” which are usually the most over-priced options.

Also, the collateral benefits of the “free trade” – being able to look at other potential opportunities, (since this position is secure from loss and requires less monitoring), and the emotional security of having your equity protected should not be overlooked.

Another benefit of the “free trade” is that it gives you time to unemotionally examine your position, without the panic other traders may experience as their profitable positions begin to nose-dive. Since you are protected you can wait for emotions to subside and the market to give you a better indication of its next move. You can then decide to hold your position and look for full profit potential (knowing you are completely protected from loss) or you can cash out and take your existing profits.”

The final benefit of “free trades” is that when these “free trades” are completed, since your capital is protected, you can turn your attention elsewhere. You may find opportunities in other markets, or even in the market you have completed “free trades” in, to add more positions. This can now be accomplished without increasing your original risk – since your first positions are now risk-free! It is difficult to closely monitor more than two or three net positions, especially in volatile markets. The “free trade” allows you to concentrate more fully on other situations.

“WHEN TO COMPLETE A FREE TRADE”

The dilemma with the “free trade” is when to “free trade” and which strike price to use. In determining this we must first realize that there is little science, but most “art” here. What we do is look for the location of the heavy resistance on the futures chart (which must correspond to a place that the market can reasonably get to within a thirty day period), and then we sell options outside of that range. For example, many years ago in March, silver was trading between $3.70 and $4.00, we recommended purchasing $4 and $4.25 silver call options, and selling options six strike prices out-of-the-money at the same price paid for the option purchased to turn these positions into “free trades.” We determined these options would be trading at enough of a premium to turn these positions into “free trades” if silver reached 420-450. However, in this silver rally we obtained an additional benefit of volatility increasing 50% or more in some cases. This allowed traders to “free trade” even more than six strike prices away (which of course allows for more profit potential).

How do we really know that this is the most opportune time to initiate the “free trades”? Traders who purchased our recommended silver calls began calling in early April after silver had risen 10-15 cents to discuss turning these positions into “free trades.” We discouraged clients from completing “free trades” at that time, not because we “knew” that the market was moving substantially higher; but we could only complete “free trades” by selling options one or two strike prices out, which we felt was not enough of a profit potential for this trade.

However, in May, after silver had risen another 50 cents, we were more receptive for “free trading” for several reasons. First, the volatility had risen making the out-of-the-money options we wanted to sell much more expensive and “overvalued” than the options we had previously purchased. Second, we could now “free trade” by selling options six strike prices out-of-the-money allowing a significant profit potential of $7,500.

Were we certain that we were correct in recommending “free trades” then? Definitely not! However, the laws of probability and “stress control” were in our favor by doing this. First, for our actions to be entirely incorrect, silver needed to take off and move at least one dollar from these levels before the expiration of the option. That is the “worst” that could have happened by completing the “free trade” at this time. And, if the “worst” occurs, we would be in a position of “only” making $7,500 per contract. If instead silver remained under the level of the option we sold, in every case we made the right decision, since this option will eventually be worthless. We protected our capital and perhaps added profits to our trade. Finally, if silver had a substantial pullback, we not only protected our original capital, but placed ourselves in a position where we could add additional positions without increasing our initial risk, thereby allowing us to build a large position.

The “free trade” also allows us to meet our objective of getting a “trading edge” over the markets by using options. You are taking advantage of the increased volatility of the out-of-the-money options, which can be quite exaggerated on market rallies.

Recent Comments