From Keith Harwood of OptionHotline…

I want to touch on the concept of trading timelines, as that’s a huge input to an options trade. If you trade an option that expires within a week, you better have a trading timeline of one week or less. If you are trading an option that expires in a year, you should probably be looking at that as a longer-term hold, otherwise you are spending more on the option premium than you need to.

With that in mind, let’s talk a bit about some of the best performers on various time horizons for 2021. Of course, everything I look at is adjusted for volatility – in that way, I can figure out which ETF’s have the best bang for their buck in the options markets.

First, let’s discuss the short-term: the last 2 weeks. In that time horizon, the clear winner has been technology. Let’s look at the QQQ ETF for an illustration of this:

QQQ has been on a major upswing for almost 2 months, but has had a really strong trend over the last 2 weeks that has been stronger than basically any other major trading sector.

(continued below)

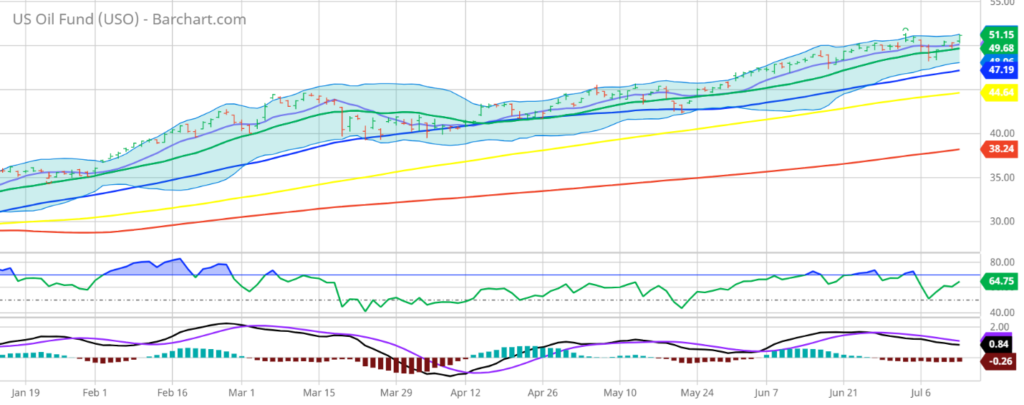

If one’s time horizon is a bit longer, then over the last 3 months, the big winner has been oil, as illustrated by the USO ETF:

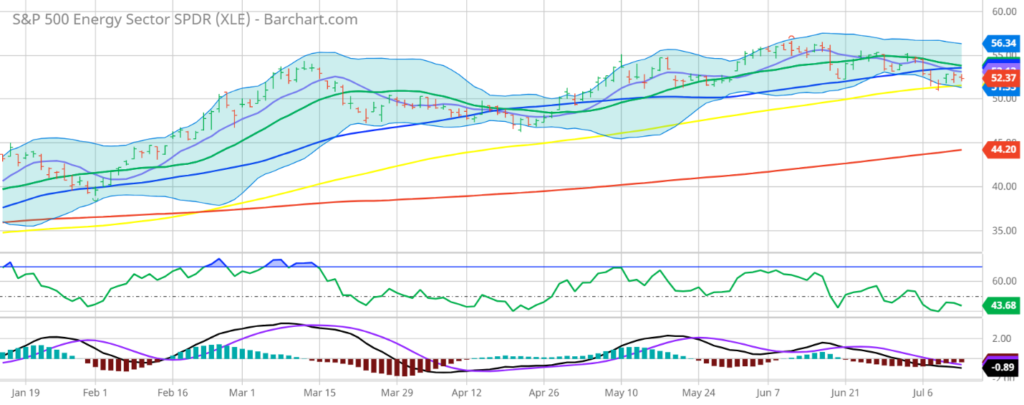

Since mid-April, there have been few-if-any pullbacks in oil, and yet the move in oil stocks has continued to lag (as illustrated by XLE, a main energy sector ETF):

Will XLE finally catch up to the move in oil? Or is this simply a commodity bull market that is not hitting the bottom line of these major oil companies?

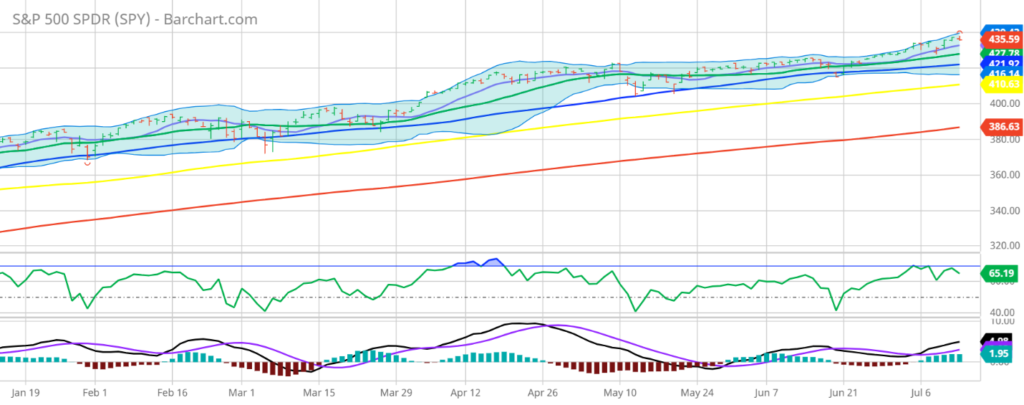

And finally, year-to-date, the big winner has been…oil! Since we already looked at that, we might as well look at the other major sector that’s been dominating this year. The secondary winner with significant trading volumes has been, amazingly, SPY:

The S&P 500 has been a better performer (adjusted for daily movement) than just about any other major sector or sub-sector out there! Over the long-term, investing in the broad market is working better than just about anything, particularly when utilizing options to leverage the moves.

So, with all of this in mind, what’s coming for the second half of 2021? Will tech continue its hot start to the second half and maintain leadership? Will oil names catch up to the move in oil? Or will there be a surprise sub-sector that dominates and performs better than simply buying into the broad market?

The key is to recognize short-term moves or long-term moves early and ride them as long as the technical setup indicates. And when paired with options, that’s how I can turn any sized move into a leveraged move. But in order to do so, I have to identify not just my trade, but also my trading timeline.

Please take this chance to review how I apply technical signals to my options trades at https://optionhotline.com and if you have any questions, never hesitate to e-mail me.

Keith Harwood

Keith@optionhotline.com

Recent Comments