What kind of risk do you want to take today?

When I look at the market, I see reasons for optimism on a technical level, and reasons for skepticism. On a fundamental basis, I see reasons for optimism, and I see reasons for skepticism. So how in the world does one try to leverage a directional move when getting mixed signals?

The first step, of course, is to determine one’s edge on the marketplace. If it’s purely on a technical basis, then Microsoft (earnings Tuesday after the close) and Meta aka Facebook (earnings Wednesday after the close) are better reviewed later this week. If it’s purely on a fundamental basis, then I truly hope that trader has a position structured for the earnings announcements of these big tech names based upon their research.

At the end of the day, when I see earnings season driving a lot of individual moves, and macro news driving a lot of macro moves, I stick with my gut and go with the technicals and the options analysis. Those are my edges. I want stocks that aren’t about to announce earnings – that information has to have already hit the market or needs to be further down the line. Or, alternatively, I’m looking at macro index products like SPY, QQQ, IWM, TLT, GLD, etc.

So, today, I’m looking at macro indexes. First, let’s look at QQQ to see if there’s a trade there:

Frankly, I would be inclined to buy into tech here, BUT we have a lot of tech earnings announcements in the coming week. There are too many fundamental inputs that could disrupt this bounce/rejection of lows to make this a feasible entry based upon technical signals.

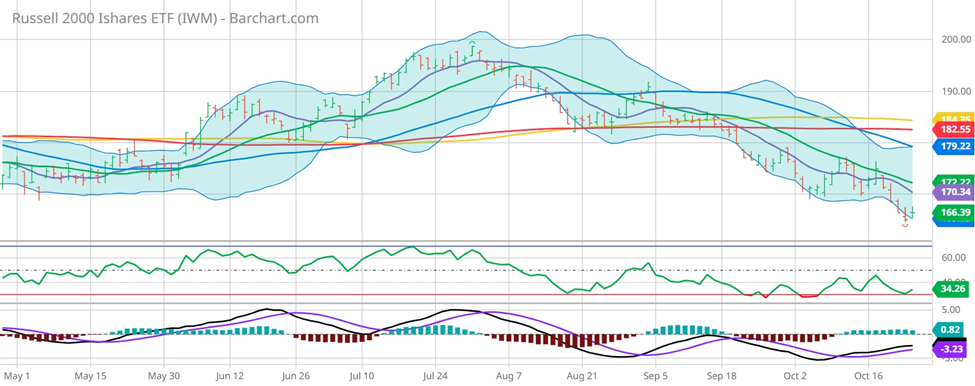

So, perhaps IWM could be of interest:

It’s showing signs of bottoming, but until it gets above the 20-Day Moving Average, I just don’t think I can try to catch that falling knife. The bounce could be what is referred to as a “dead cat bounce” where a stock bounces just to trap traders into thinking the low is in, and then collapses even further. The real name for the technical formation is a bear flag, by the way.

So, perhaps the key here is to recognize that stocks may not be the best answer, but rather, it’s time to focus on the index that had everyone panicking due to how it’s impacting stocks: TLT, the 20+ year bond ETF:

Now this is something I can wrap my head around. A small upward move gets it above the 20-Day Moving Average, which has proven to be resistance over the last few weeks. Additionally, the MACD crossover occurred with a bullish signal a few days ago, indicating that bonds could be bound for a recovery.

Of course, for me personally, I’ll now take that input and apply it to my research on many individual names that I know tend to be positively correlated to bonds. I’ll then look for names to add to my Outlier Watch List that can perform strongly in a bullish bond environment, figure out how best to leverage those trades with options, define my risk, and look for some really interesting trading strategies. If you want to learn more, make sure you sign up for my Outlier Watch List now!

As always, please go to http://optionhotline.com to review how I traditionally apply technical signals, volatility analysis, and probability analysis to my options trades. As always, if you have any questions, never hesitate to reach out.

Keith Harwood

Keith@optionhotline.com

Recent Comments