Friday, June 4th, 2021

Boeing Launches New Uptrend

Happy Fabulous Friday!

I teach everyday people (like me) to trade options. I do my best to write in an understandable way as if we are talking over the kitchen table.

The week has been positive for 3 days in a row without as much volatility as we have been seeing in the past weeks. One of the benefits of trading weekly chart patterns is that it cuts out a lot of the back-and-forth movement and focuses on longer term patterns.

For today’s Trade of the Day, we will be studying Boeing Company, symbol (BA). It pulled back in March, April and the first weeks of May. Now, it is heading up.

Before analyzing BA’s chart, let’s take a closer look at the company.

The Boeing Company, together with its subsidiaries, designs, develops, manufactures, sales, services, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems, and services worldwide. The company operates through four segments: Commercial Airplanes; Defense, Space & Security; Global Services; and Boeing Capital.

The company was founded in 1916 and is based in Chicago, Illinois.

BA has risen the last 2 weeks after a two and a half month drop and looks ready to head higher.

Let’s take a look at BA’s weekly chart.

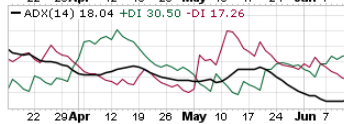

The +DI (green line) is just now crossing up. As long as it is above the -DI, price should rise. Green above red is an indication of strength. The +DI being in charge is bullish and the ADX turning up shows strength. If you want to learn more about ADX, read on or, if not, scroll down to the alert.

Average Direction Index (ADX) – Strength Indicator

The Average Directional Index consists of 3 lines: Green, Red and Black.

Green = +DI (Bullish)

Red = -DI (Bearish)

Black = ADX Strength Line

The DI line that is on top is in control. If the ADX line is heading up, strength is supporting the DI line that is on top and in control.

Check Out the Trade Alert Signal

Each candle on the chart represents price movement over a 5-day (week) period; therefore, it takes weeks for trades to play out. On the chart, 3 weeks have risen in May and now into June. When the +DI crosses over the -DI line, it gives a buy signal [as the +DI line (green) appears as if it is in control and ready to head up on the ADX indicator], and if the ADX turns up that even more bullish, suggesting an upward move is gaining strength. I’d like to see the green line to continue its upward bias and then the black line to turn up as well. When it also turns up will be great- all are bullish signs of strength. When the +DI crosses the ADX (black line) and when it rises, it shows a new burst of strength coming into the equity.

The Black ADX line is a strength line and as long as, it continues to head up, it shows strength, and, once it happens, we will know strength will continue to flow into this equity. We will keep an eye on BA over the course of the next few weeks.

The short-term price target for BA is $270 and then 280, perhaps higher.

BA Potential Trade – Showing Strength

This signal could give a quick payout if it continues its upward move, and the strength of this pattern continues. It looks as if it could push above $270.

To buy shares of BA today would cost approximately $259 per share and if it reaches its near-term target of $270 that would be a gain of $11.

This is a great example of the benefits of trading options. Let’s discuss this as a study case.

Option trading offers the potential of a lower initial investment and higher percentage gain. Let’s take a look and make a comparison.

If the plus DI (green line) stays above the -DI (green) line by Friday:

If you bought 3 shares of BA at $259, you would invest $670. If the stock increased in price to $270, you would earn a profit of $11 per share or $33 for the 3 shares or about 4%.

If you bought one option contract covering 100 shares of BA with a July 16th expiration date for the $270 strike and premium would be approximately $7.20 today or $720 per 100 share contract. If price increased to the expected $270 target or a gain of $11 over the next few weeks, the premium would likely increase $11 to $18.20 ($11 x 100 share contract = $1,100 Profit. $1,100 profit on your $720 investment, this is a 153% gain. Nice! Terrific trade if it hits it target!

Trading options is a win, win, win opportunity. Options often offer a smaller overall investment, covering more shares of stock and potential for greater profits.

I like to stress when trading options, you don’t need to wait for the expiration date to close the trade. You can close anywhere along the way prior to the expiration date. It is never a bad idea to take profit.

Trading options is like renting stocks for a fixed period of time. The potential to generate steady income with options is real and it can be transforming.

PS-I have created this daily letter to help you see the great potential you can realize by trading options. Being able to recognize these set ups are a key first step in generating wealth with options. Once you are in a trade, there is a huge range of tools that can be used to manage the many possibilities that can present themselves. If you are interested in learning how to apply these tools and increase the potential of each trade, click here.

Past Equity Candidates:

Twelve weeks ago, we looked at Kellogg’s (K). It is at 66.30 as I type on Wednesday, surpassing its strike of 65 and then slipped a little. It has until June 18th expiration to go even higher.

Eleven weeks ago, we discussed Nikola (NKLA) it has been up the last two weeks and then pulled back a little this week. It has not done well at all. It has dropped below support levels. It is still way down below its expected target of 25 and has until June. It is currently at 18.02.

Eight weeks ago, we examined MSFT. It moved as high as 260 well above its 255 target and it has a June expiration. Premium more than doubled. This week it is down well below its strike at 246.59.

Seven weeks ago, we looked at Peloton (PTON) and its plus DI line crossed down and negated the entry signal. Since then, it had headed down. This happens sometimes. A symbol looks as if it is ready to head in a new direction and then, it turns on its heel and heads in the opposite direction. This why it is important to wait for a confirmation or sell as soon as there is a reversal that negates the symbol. PTON headed up two weeks ago and last week, but it has a long way to go before it reaches the entry area again. Its strike was 135 with June expiration. It is at 108.35.

Recent Comments